May 2020 Insights

A Message from Our CEO—Looking Ahead

Dear Members,

In light of Governor Kemp’s recent announcement of a timetable to allow the opening of a variety of businesses in Georgia, we want to provide you with as much clarity as possible on our plans to resume more normalized operations as we manage through the corodivirus pandemic.

As of now, we believe it is prudent to maintain the drive-thru and appointment-only format in our branches until at least the week of Monday, May 18, for the continued health of our members and employees. Between now and May 18, we will continue to carefully evaluate both the trend with COVID-19 cases in the state; guidance from public health officials; and feedback from you, our members. A week prior to May 18, we will assess the appropriateness of reopening the branch lobbies on that date and decide when and how to cautiously move forward.

Delta Community’s self-service channels, such as Online Banking and our award-winning Mobile App, provide you with secure, quick ways to review account balances, pay bills, deposit checks, transfer funds and more. If you do need to visit a branch, please consider one of our 14 branches with drive-thru lanes. For more complex transactions, you can make an appointment at your preferred branch by using the online scheduling tool on the homepage of our website. And, of course, Our Member Care Center can be reached 24/7 at 800-544-3328 if you have questions or need assistance.

While we are helping you manage your finances, we also very much care about the personal well-being of you and your family. That’s why we will continue to let you know what we’re doing to sustain our operations in a safe, responsible way.

We appreciate the opportunity to serve you and remain committed to providing you consistent, exceptional service — today and always.

Sincerely,

Hank Halter

Chief Executive Officer

New Full-Service Branch to Open in Cumming

Delta Community recently named Cumming as the home of our 27th branch location in metro Atlanta and 30th branch overall. The full-service branch will open in the fall of 2020 and will be located at 445 Peachtree Parkway. It will house full-service teller operations, three drive-through lanes and two ATMs, as well as a complete team of financial professionals to assist Delta Community members with their home, auto and personal loan needs. We look forward to serving our members, and welcoming new ones, with this new, convenient location. Follow us on Facebook for updates regarding the progress and opening of the Cumming Branch.

Help Positively Impact a Child's Life with Bill Pay

During these difficult times, many of us are looking for ways to help. Delta Community is partnering with Children’s Healthcare of Atlanta (CHOA) as a way for our members to help one of Atlanta’s best hospitals during the current health crisis. When you make a qualifying Bill Pay transaction between April 14 and June 15, $1 will be donated to CHOA, where doctors, nurses and staff are trained to care for children under the age of 21. Qualifying Bill Pay transactions include:

- Adding and paying a new biller

- Activating a new eBill

- Setting up an automatic payment1

Experience the convenience of Bill Pay and help Children’s Healthcare of Atlanta today.

Delta Community Employees Continue to Serve Members

Banking, like everything else, looks very different these days, but we are so proud of our employees that have embraced a new normal and work hard every day to help members like you. While many of our employees are able to work remotely, our frontline teams still come to work in the branches to assist members with transactions via drive-thru banking and in-branch appointments. These employees often go above and beyond to provide excellent service to members. For example, we had one employee walk printed statements out to an elderly member’s car, who was concerned about coming inside the branch. This extra dedication from our employees has been noticed by members, who have responded with praise in emails and social media, such as “The Snellville location did an excellent job taking care of me as a customer…they acted and performed in a very professional manner!” We are very grateful for members taking time to write to us: “I come into your branch monthly and am always received so warmly...I appreciate the stellar customer service. It seems to be a lost art in so many companies today. This branch scores 10 out of 10, and thanks for the great job.”

And it isn’t just in our branches! Our Member Care Center agents, while working remotely, are also fielding significantly more calls than ever before. While wait times might be longer than they were a few months ago, our team is striving to provide prompt assistance and issue resolution to everyone who calls. Our employees truly appreciate the kind words during these unprecedented times, and if there is more we can do to be of service, please let us know.

Delta Community Vehicle Loans—Here to Meet Your Needs, Affordably

Delta Community is offering members low rates on new and used Car Loans from now until May 31, 2020. Well-qualified borrowers with excellent credit can get rates as low as 1.98% APR.2

In addition to low rates, you can take advantage of:

- Applying from the comfort of your own home with our easy online application process.

- Defer your payments for up to 60 days3

- No pre-payment penalties

As an added bonus, members who finance their Car Loans with us and purchase their car through Carvana will receive an extra .50%4 off their already low rates. Carvana offers a convenient, touchless, online car-buying experience with more than 15,000 vehicles to choose from. Every vehicle comes with Carvana’s 7-Day Return Policy and you can also get a real offer for your trade in, in minutes.

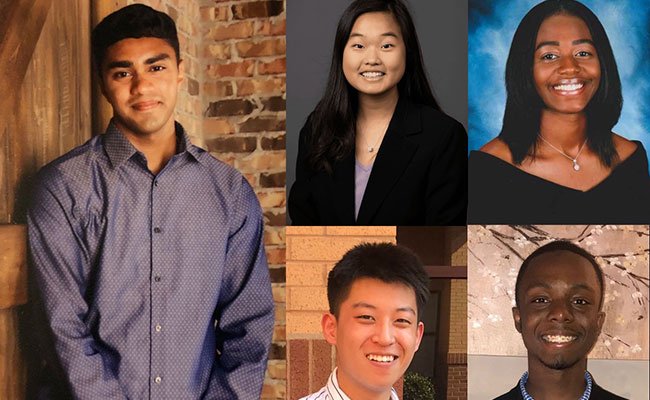

2020 Scholarship Recipients Announced

We recently announced the 2020 recipients of our annual Scholarship Program. Now in its 15th year, the program awarded a total of $25,000 to the following five metro students based on academic achievement, community service and submission of an essay topic selected by the Credit Union.

- Naren Matcha (left), a senior at Milton High School in Milton, Georgia, plans to major in Biology at the University of North Carolina Chapel Hill.

- Sophie Zhang (top left), a 2019 graduate of Dunwoody High School in Atlanta, is currently majoring in Industrial Engineering at the Georgia Institute of Technology.

- Kennedy Head (top right), a senior at McEachern High School in Marietta, Georgia, plans to attend Jacksonville State University with a career goal of becoming a Nurse Practitioner.

- Adam Shi (bottom left), a student at Lambert High School in Suwanee, Georgia will attend the University of Pennsylvania with a career goal of integrating farming with philanthropy by developing and donating hydroponic greenhouses to communities in Africa and Asia.

- John Atkinson (bottom right), who attends Centennial High School in Roswell, Georgia, plans to study Marine Biology at Harvard University.

For more information about these exceptional students and additional program details, visit DeltaCommunityCU.com/Scholarship.

Philanthropic Fund Grants Awarded in April

We recently awarded two more grants from our 2020 Philanthropic Fund, totaling $7,500, to the organizations listed below:

- Westside Future Fund received $2,500 to help them on their mission to advance a compassionate approach to neighborhood revitalization that creates a diverse, mixed-income community, improves the quality of life for current and future residents and elevates the Historic Westside's unique history and culture.

- Playworks Georgia, pictured above, accepted an award of $5,000 for their mission to improve the health and well-being of children in Georgia elementary and middle schools. They do this by increasing opportunities for physical activity and safe, meaningful play.

The Delta Community Philanthropic Fund will invest a total of $100,000 throughout 2020 to 18 metro Atlanta non-profit organizations that support the physical and financial needs of people who live within the communities we serve.

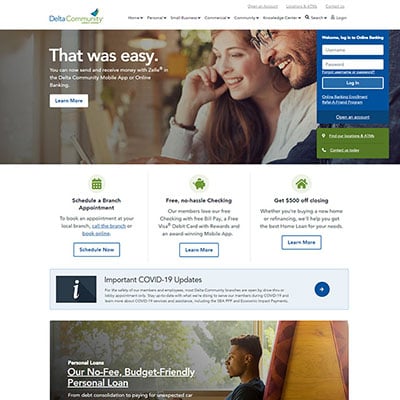

Refreshed Website Offers New Design and Optimal Viewing

Our refreshed website is coming soon and is being redesigned to better serve your banking and financial service needs. The refreshed site will feature a modern new layout and fresh colors and graphics. Additionally, the pages will be easier to read, faster to load and the responsive design will allow for optimal viewing on both large and small screens, including tablets and mobile phones.

Financial Education Center Update—Planning Through Transition

Delta Community’s Financial Education Center is designed to improve the financial lives of our members and community by offering workshops on a variety of topics. For the month of May, Delta Community will present a special workshop called Financial Planning Through Transition. This live webinar may be helpful for those who are facing a layoff or are considering early retirement and want to understand what lifestyle adjustments they may need to make. 401(k) options and decisions, healthcare coverage, pension and Social Security timing will also be discussed.

- May 5: Financial Planning Through Transition | Webinar

- May 7: Financial Planning Through Transition | Webinar

- May 13: Financial Planning Through Transition | Webinar

- May 21: Financial Planning Through Transition | Webinar

Join one of our CERTIFIED FINANCIAL PLANNER™ professionals for this timely webinar. Register today on the Financial Education Center calendar.

Monthly Blogs

- Working from Home? Here are 15 Financial Tasks You Can Do Now: From the privacy of your home, you can invest time in personal financial matters that you might not be able to focus on at your workplace. Every year you should take a look at your income, expenses and budget and adjust them. Now during the COVID-19 pandemic, which has affected many Americans’ careers and finances, it’s especially important to make certain that you’re managing your money thoughtfully.

- What to Expect If You're Expecting a Government Impact Payment: This past March, U.S. government leaders said that they intended to send economic impact payments (through direct deposit to an account or by a paper check in the U.S. mail) to many Americans to help them pay expenses during the COVID-19 pandemic. On March 30, the U.S. Treasury Department and the Internal Revenue Service (IRS) provided more details on these payments, including information on who will receive them and how they will be distributed.

- 2019 Tax Deadline Extension, IRA/HSA Contributions, and Paying Taxes: This March the Treasury Department and Internal Revenue Service announced that the federal income tax filing due date is automatically extended from April 15, 2020, to July 15, 2020; this date change also automatically extends the ability to contribute to Individual Retirement Accounts/Health Savings Accounts for the 2019 tax year to July 15.

- Important Financial Education for Select Employee Groups During the Pandemic: As the COVID-19 pandemic impacts all of us now—and may affect the world for months—improving your financial knowledge could be essential in helping sustain your financial well-being. Key information may assist you in overcoming any setbacks that you may encounter during this unique and challenging time.

Financial Status

As of March 31, 2020:

Assets: $6.5B | Deposits: $5.6B

Loans: $4.9B | Members: 417,543

Holiday Closings

Memorial Day

Monday, May 25

2020 Holiday Closings

Websites

Home Page

Members Insurance

Careers

Contact Us

Member Care: 800-544-3328

Home Loans: 866-963-7811

Locations

EVERYTHING YOUR BANK SHOULD BETM

1 Each of the Bill Pay payments must be at least $10 and must be paid to another party with a different mailing address from the primary online banking account holder. Your Delta Community Credit Union account must be in good standing. Business accounts are excluded. All charitable donations will be paid by Delta Community’s Bill Pay provider, Fiserv.

2 Must apply on or after May 1. Rates expressed as Annual Percentage Rate (APR). Rates are based on creditworthiness and term of loan. APR available through May 31, 2020. Income verification may be required.

3 Restrictions apply. Offer valid through May 31, 2020. Member can defer first payment up to 60 days. Finance charges continue to accrue as of the loan date. Member is responsible for all payments.

4 Services offered through Carvana are separate and distinct from any business conducted with Delta Community and are not guaranteed by or obligations of the Credit Union. Additional .50% APR discount is only available for Carvana purchases made May 1 - May 31, 2020.