Delta Community Insights for June 2021

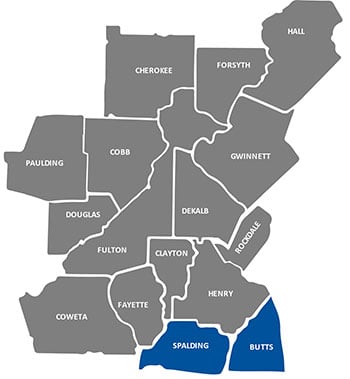

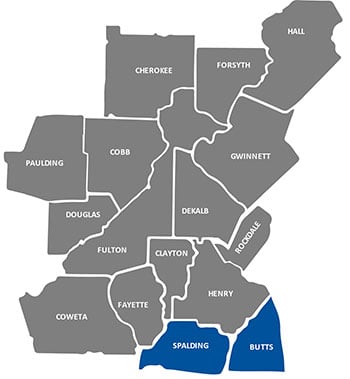

Our Community is Expanding

We are excited to announce that we have expanded our field of membership to serve people living or working in Butts and Spalding Counties. With this expansion, membership with Delta Community is now open to residents of 16 metro Atlanta counties. “We are honored to have this opportunity to offer consumers in Butts and Spalding counties the same personalized care, trusted advice and honest value that's at the heart of our member-owned, not-for-profit structure,” said Delta Community CEO Hank Halter. “As in all communities we serve, we also look forward to supporting local charitable and educational initiatives that are important to our members and employees.”

Plan it With a Personal Loan

Do you need a little extra cash? With the flexibility of a Personal Loan, you can finance the things that are most important to you right now. We offer great low rates, a variety of repayment options and fixed terms with no annual fees. With a Delta Community Personal Loan, you can take a much-deserved vacation, finance home improvements, cover education expenses, consolidate high-interest debt or fund your new-found hobby.

The benefits of a Personal Loan from Delta Community go beyond having extra cash. They include a super-fast approval process and quick access to your funds – all from a lender you can trust. Log in to Online Banking or our Mobile App to apply, or call our Loan Consultants at 844-544-9478 today!

HBCU Scholarship Application Period Closing Soon

Throughout 2021, Delta Community is awarding $10,000 in scholarships to four students of Historically Black Colleges and Universities (HBCUs). We are currently accepting nominations for our second quarter HBCU Scholarship through June 6. If you know an exceptional student currently attending a Georgia HBCU or a graduating high school senior who has received an official acceptance letter to one, tell us why they deserve to receive a $2,500 scholarship. Delta Community will select one winner from among the most compelling submissions and share their profile on our website and on social media sometime in late June.

The HBCU Scholarship is part of our annual Scholarship Program. Visit our website to learn more about all of the scholarships that we offer.

Positively Impact a Child's Life with Bill Pay and Zelle®

Looking for a way to give back? Delta Community is partnering with Children’s Healthcare of Atlanta (CHOA) as a way for our members to help one of Atlanta’s best hospitals. When you make a qualifying Bill Pay or Zelle transaction now through June 30, $1 will be donated to CHOA, where doctors, nurses and staff are trained to care for children under the age of 21. 1

Qualifying transactions include adding and paying a new biller, activating a new eBill,2 setting up an automatic payment3 and sending $5 or more to a new person using Zelle. 4

Experience the convenience of Bill Pay and Zelle and help Children’s Healthcare of Atlanta today.

Philanthropic Fund Grants Awarded in May

We recently presented two more grants from our 2021 Philanthropic Fund, totaling $5,000, to the organizations listed below:

- The Elaine Clark Center, pictured left, was awarded $2,500 for their program to help children and young adults of all abilities become confident and contributing citizens of the community. They do this though an innovative model of education, therapeutic play and experiential opportunities.

- NAMI Georgia, pictured right, received $2,500 to go towards their missions to create communities where all affected by mental illness find hope, help and acceptance through support, education and advocacy. These funds will help with their Family to Family Class, a support program for parents and other caregivers or individuals with mental health conditions.

The Delta Community Philanthropic Fund will invest a total of $125,000 throughout 2021 in 20 metro Atlanta non-profit organizations that support the physical and financial needs of people who live within the communities we serve.

Mother's Day Giveaway Winners

In celebration of Mother’s Day, we recently conducted a special “Mother’s Day Giveaway” promotion on our Facebook page. Members were invited to post comments on our page about the impact their moms, grandmothers, wives or other mother figures have had on their lives, and two lucky moms won $50 Target gift cards. Our winners, Emily, who nominated her sister Linda (pictured left) and Nick, who nominated his wife Ashley (pictured right), submitted the following entries:

Emily says, “ I nominate my sister, Linda. She is an amazing mom to two autistic kids and has a third child on the way. It takes a special person to be such a great advocate and support system to such special children. She is also a great sister. ”

Nick nominated his wife with, “ My son’s stepmom is patient, kind, loving and she is always there when he needs her. I love them both endlessly and I am so grateful she is in my life because I could not ask for anyone better. She encourages him to be himself more than anyone in his entire life and always accepts him for what makes him himself. I never see him really relax and let loose and be himself the way he does when he is with her and it is so heartwarming. Happy Mother’s Day to all the great moms! ”

Be sure to follow us on Facebook for a chance to enter our next photo submission contest.

Financial Education Center Seminars

At Delta Community, we know that knowledge is the key to reaching your financial goals and establishing good financial habits. That’s why we’re offering a series of workshops each month focusing on a different aspect of personal finance. Whether you’re planning for a major milestone or trying to better manage your finances, our Financial Education Center offers the tools to help you achieve financial success.

Our June series will focus on Investing. We’ll discuss the importance of investing for the future and the benefits of different types of investment accounts, the building blocks that form basic investment principles, real-world financial situations, and the importance of a personalized investment roadmap.

- June 9: Intro to Investing | Live Webinar

- June 22: Investing 201 | Live Webinar

- June 30: Investing 301 | Live Webinar

Check our Events & Seminars page for more information on upcoming seminars.

Monthly Blogs

- How to Tell If Someone’s Stolen Your Identity and How to Prevent It: Identity theft can be devastating for victims, as the thieves can take over any of your financial and utility accounts, your federal and state tax accounts, your health insurance, and state unemployment insurance account. There are clear clues that can indicate that someone may have stolen your personal information and are using it to benefit themselves and harm you.

- Protecting Yourself Online While Working or Learning from Home: Over the past year, and primarily because of the COVID-19 pandemic, many more people have become used to working from home (“WFH”) regularly, taking online classes, or overseeing their children using remote learning. All of this dedicated online time means that there are more opportunities for your work computer, home network, and personal computer to be exposed to cyberattacks. It’s important to always be alert to threats online. Read our suggestions for enhancing your online protection while working or learning at home.

- What to Do with the Money You Saved by Quarantining at Home: Earlier this year the blog suggested how to use your 2020 stimulus payment, tax refund, commission or bonus wisely, and here are some additional spending and saving recommendations for what may be a new source of available funds for some of us—quarantine savings.

Financial Status

As of April 30, 2021

- Assets: $8.5B

- Deposits: $7.6B

- Loans: $4.9B

- Members: 443,645

Holiday Closing

Independence Day

Monday, July 5

Contact Us

Member Care: 800-544-3328

Home Loans: 866-963-7811

Locations

EVERYTHING YOUR BANK SHOULD BE™

1. Maximum donation is $10,000 total for all campaign participants throughout 2021. Your Delta Community Credit Union account must be in good standing. Business accounts are excluded. Employees of Fiserv, Inc. and of Delta Community Credit Union and their respective parent and affiliate companies, as well as board members and the immediate family (spouse, parents, siblings and children) and household members of each such employee are not eligible. Rules are subject to change without notice.

2. eBill is an electronic version of a paper bill sent directly to you when a new statement is made available. eBills are sent from a biller to your Delta Community Bill Pay account the same way a paper bill arrives to your home mailbox. Our Bill Pay allows you to view all your eBills—as well as account balances, transactions and statement information—in one convenient place. Also, for additional convenience, you can set up email notifications for when a new eBill arrives in your Bill Pay account. You can set up eBills for any payee that displays an active eBill link in the Bill Pay Payment Center. Just click eBill and follow the simple steps.

3. AutoPay is a means to set up repeating payments in Online Bill Pay. You can set up AutoPay for any company or person you pay regularly. You can set up and manage AutoPay and Reminders from the Payment Center. You can set up payments to be made based on a schedule that works best for you. You can change or stop AutoPay at any time.

4. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. THIS PROMOTION IS IN NO WAY SPONSORED, ENDORSED, ADMINISTERED BY OR ASSOCIATED WITH EARLY WARNING SERVICES, LLC OR ZELLE®.

Insured by NCUA.