Why should I choose a Money Market Account (MMA) rather than opening a CD?

Unlike a CD, the funds in your MMA are not tied to a specific term so you have easier access to funds.

Can I have direct deposit to my Money Market Account?

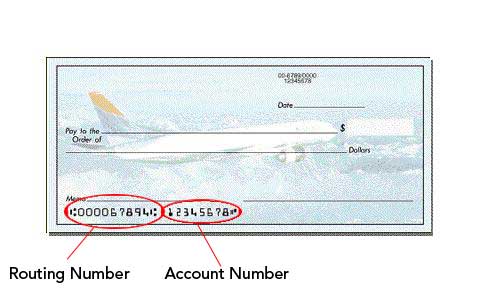

Yes. You may set up direct deposit with your employer by providing them your account number and routing number. Ensure that your employer lists your personal MMA as a checking account rather than a savings account to avoid any issues with your deposit.

Can I use my Visa Debit Card to access my Money Market Account?

Your Visa Debit Card will not give you access to your Money Market Account. ATM cards for an MMA can be issued which can only be used to withdrawal funds at an ATM. Money Market ATM cards cannot be used for Point of Sale (POS) transactions, such as paying at the gas pump or grocery store.

When accessing funds at an ATM with your Money Market ATM card, choose a withdrawal from checking to access the Money Market account.

Can I transfer funds from my Money Market Account online or by using Self-Service IVR?

Yes. There are several ways you can transfer funds from your Money Market Account to another share or loan:

- Transfer funds in your Online or Mobile Banking

- Request to transfer funds by clicking Contact Member Care located in the top-right corner within Online Banking

Can I have more than one Money Market Account?

Yes, you may open more than one Money Market account and can do so online using your Online Banking or by phone by contacting our Member Care Center at 800-544-3328.

If I have a Money Market Account (MMA) on my personal account, can I order a different check design from an outside vendor?

Yes. However, please be advised of the following:

- Checks ordered from an outside source will generally require a larger order than is necessary. This is important to consider since check writing limitations exist on an MMA. The available checks ordered from Delta Community come in a box of 40.

- Additionally, ordering checks from an outside vendor means providing your account number and routing information to an unverified third-party. We cannot guarantee the safety and privacy of that information once you release it.

- Checks cannot be ordered for a Money Market account associated with a business account.