-

How do I use a chip card?

-

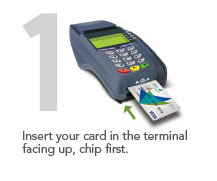

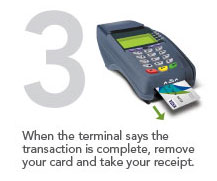

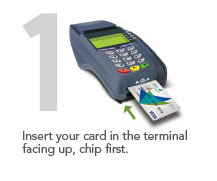

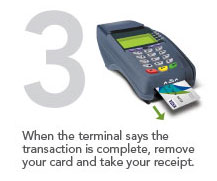

When using a chip-activated terminal, follow these easy steps:

-

How will my checkout at the register be different with a chip card? With a chip card, do I need to swipe my card?

-

If the merchant has a chip-enabled terminal, insert your card and follow the prompts on the screen (the slot is typically located at the bottom of the terminal). Leave your card in the terminal until prompted to remove it. If the merchant does not have a chip-enabled terminal, you will swipe your card exactly as you would with a non-chip card. If you swipe the magstripe on a chip-enabled terminal, the terminal will prompt you to dip your card by inserting it chip first.

-

Is anything different for online or telephone transactions?

-

No. You use your chip card for online purchases the same way you use non-chip cards. You can also enjoy an easy, smart and secure digital checkout experience when you click to pay with your Delta Community Visa Debit or Credit Card when you see where Visa is accepted. Set up your cards today. And, you are always protected with Visa's Zero Liability Policy* against fraudulent activity.

where Visa is accepted. Set up your cards today. And, you are always protected with Visa's Zero Liability Policy* against fraudulent activity.

-

Why do some merchants require the use of a PIN for debit transactions, rather than allowing people to sign for their purchase?

-

Delta Community’s Debit Cards are designed to work as chip and PIN or chip and signature. Whether you need to sign or use your PIN depends on the merchant, the amount you’re spending and which buttons you push at the terminal prompts.

-

Do I need to use a PIN with my Visa chip Credit Card?

-

No. For U.S.-based transactions, you only need to use a PIN with your Credit Card if you’re requesting a cash advance at an ATM. If you’re traveling overseas, you may want to consider getting a PIN for your Delta Community Credit Card prior to departing.

-

How will I know if I need to insert or swipe my new card?

-

If the card terminal is chip-enabled, you will see a slot where your card is inserted and where it will remain during the transaction.

-

What if the merchant doesn’t have a chip-enabled terminal yet?

-

Your Delta Community Visa Card still has a magnetic stripe, so if a terminal is not chip-enabled, simply swipe your card the way you do now.

-

Will my chip card work at a non-chip-enabled ATM?

-

Yes, it will. Most ATMs are chip-enabled, however. If you use an ATM that is chip-enabled, it may briefly retain the card inside the machine/reader while your transaction processes. Please remember to take your card after your transaction is complete.

-

Even though chip cards have an extra layer of security, should I still contact Delta Community before traveling internationally?

-

Yes, that’s still a good idea. That way, purchases that are outside of your normal purchase activity are less likely to trigger our fraud monitoring systems.

-

I’m having trouble using my new chip card on a mobile device app (such as loyalty programs). What should I do?

-

Because the card is flat, some mobile device cameras may not pick up the card number or other information. If this happens, simply enter the required information manually.

-

What should I do if I have additional questions that aren’t addressed here?

-

Call 800-544-3328, stop by any Delta Community branch or send a secure email through Online Banking.