February 2026

Your Digital Banking Just Got Better

We’re excited to share that Delta Community’s Online and Mobile Banking experience has been refreshed with new features and a more intuitive design to help you manage your money more easily—anytime, anywhere.

With this update, you’ll notice:

- A cleaner, modern layout with streamlined navigation that helps you get things done faster.

- A personalized dashboard that lets you rearrange and highlight the tools you use most.

- A new Quick Links section in your Online Banking main Accounts page providing convenient access to statements, transfers offers and payment details—all in one place.

- Consistent look and feel across online and mobile platforms so your experience feels familiar whether you’re on your computer, phone or tablet.

These enhancements are part of our ongoing commitment to making digital banking more powerful and easier for you to use.

Up to $50,000 in Scholarships Available for Deserving College Students

Delta Community is proud to support students through two exciting scholarship programs offering a combined $50,000 in education funding!

Annual Scholarship Program

Applications are now open for our 21st Annual Scholarship Program, which will award $25,000 in scholarships to five outstanding students. Each recipient will receive $5,000 based on academic achievement, community involvement and an essay submission.

To qualify, applicants must be Delta Community members enrolled full-time at an accredited U.S. college or university for the Fall 2026 semester.

Apply by March 1 at DeltaCommunityCU.com/Scholarships. Winners will be announced in early April.

HBCU Scholarship Program

Our first HBCU Scholarship entry period of 2026 is also underway, offering another $25,000 in scholarships for students attending historically Black colleges and universities.

Delta Community will award three $5,000 scholarships this round, based on compelling personal submissions. You may nominate yourself or someone else — whether a current HBCU student or a graduating high school senior with an official HBCU acceptance.

Submit your entry by April 30 at DeltaCommunityCU.com/HBCU.

End-of-Year Tax Documents Available

It’s tax season! Delta Community members enrolled in Online Statements can now access their 2025 tax documents in Online Banking and our Mobile App. As applicable, tax documents will be presented under the December 2025 tab in your Online Statements. You can view and download your documents or print hard copies if you need them.

If you are not currently registered to receive your Delta Community statements online, you can quickly and easily sign up now and get both your account statements and tax documents. Simply log in to Online Banking and select Statements under the Account Services tab.

Documents we make available for downloading include: 1098, 1098E, 1099-A, 1099-C, 1099-INT, 1099-Q, 1099-R and 1099-SA.

Do More with a Delta Community Personal Loan

Whatever you’re planning, a Delta Community Personal Loan can help you move forward with confidence. Whether you’re looking to consolidate higher-interest debt,1 refresh your home, replace appliances or handle unexpected expenses, a Personal Loan offers flexible support when you need it most.

And the benefits go beyond extra cash. Enjoy a streamlined approval process and fast access to funds—all backed by a lender you know and trust. You can easily apply through Online Banking, our Mobile or call our Loan Consultants at 844-544-9478 to get started.

Start Small Youth Challenge

Saving is one of the most valuable lessons we can teach our children—and this February, we’re making it fun! The 2026 Start Small Savings Challenge2 encourages families to work together to find creative ways kids can save. We will randomly select 20 young savers to win $50 each to top off their savings. To enter, complete and return the entry form by February 28. Learn more and get started at DeltaCommunityCU.com/StartSmall.

This challenge also marks the debut of our new youth characters, illustrated by metro-Atlanta local artist Arzialous, who is also a former Delta Community Sandy Saver. Now a professional illustrator, Arzialous brings creativity, heart and a personal connection with Delta Community to this project. We are excited to share their work and continue inspiring the next generation of savers.

Supporting Affordable Housing in Our Community

Delta Community Credit Union is proud to support City of Refuge in expanding affordable housing opportunities in metro Atlanta. As a member of the Federal Home Loan Bank of Atlanta, Delta Community helped secure a $1.25 million Affordable Housing Program grant to support the construction of 35 new multifamily rental units for individuals and families in need.

“We are proud to support City of Refuge, whose project will have a lasting, positive impact on metro Atlanta families,” said Hank Halter, CEO of Delta Community Credit Union. “This partnership reflects our commitment to strengthening communities and supporting long-term housing stability.”

Delta Community has a longstanding partnership with City of Refuge, supporting its efforts to provide housing, education, wellness and job training. In recent years, we’ve awarded the organization a $10,000 grant through our 2024 Philanthropic Fund and contributed another $10,000 in 2025 through program and event sponsorships. These new homes mark the final phase of City of Refuge’s “Breaking Barriers. Building Momentum” campaign and will expand access to safe, affordable housing across the region.

Philanthropic Fund Grants Awarded in January

We are proud to announce the first four recipients of Delta Community’s 2026 Philanthropic Fund, with a total of $30,000 awarded to organizations making a meaningful impact in our communities:

Whitefoord, Inc., who received a $10,000 grant, works to create access to quality healthcare through patient-centered services and programs that address social risk factors. With support from this grant, Whitefoord expanded its School-Based Health Center at KIPP Woodson Park Academy, providing students with on-site access to primary and preventive care, including immunizations, physicals and chronic condition management. By removing barriers to care, the program helps students stay healthy, focused and ready to learn while strengthening the overall school community.

The Bridge, Inc. received $7,500. They work to support youth and families through education, youth development and essential human services. This grant helps fund the organization’s Food-To-THRIVE program, which provides families with shelf-stable foods, fresh produce, meats and bread in a welcoming, family-centered pantry setting. With this support, The Bridge expects to distribute more than 1,500 bags of food in the coming quarter, helping address food insecurity across the communities it serves.

Hillside, Inc. helps children and families thrive by providing residential and community-based mental health services. Their $7,500 grant will support the expansion of Hillside’s Connecting Communities program in 2026, growing from four to ten afterschool locations across metro Atlanta. The program offers weekly sessions and coordinated family support, helping strengthen emotional well-being and family connections for children and youth.

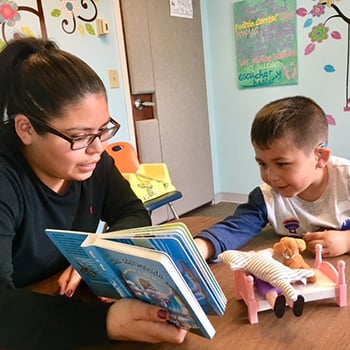

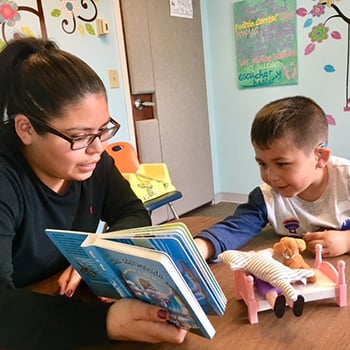

The Auditory Verbal Center, pictured, expands access to auditory verbal therapy for children with hearing disabilities. They received a $5,000 grant to support the Teaching Critical Literacy Skills program, providing intensive weekly therapy for infants and preschool-aged children with moderate to profound hearing loss. By focusing on listening and spoken language development, the program helps children build essential communication skills during their earliest years.

Each of these organizations is making a powerful difference in the lives of children and families across our community. We are honored to support their work and remain committed to investing in programs that strengthen and uplift our communities.

Show Your Support—Vote for Delta Community in the “Best Of” Awards

Delta Community Credit Union has been nominated in two local “Best Of” awards programs, and we’d love your vote! These annual, community-based awards are hosted by local publications and give members the opportunity to recognize their favorite businesses and organizations, including Best Credit Union.

Vote now for Best of Cherokee, open through February 13, 2026.

Voting for Best of Perimeter runs from February 15 through March 15, 2026, and you can cast your vote here.

The “Best Of” awards are driven entirely by public participation, meaning every vote truly counts. Your support helps keep Delta Community visible in the communities we serve and reinforces the strong connections we’ve built with our members. Thank you for taking a moment to vote and for continuing to support Delta Community Credit Union—we’re proud to serve you.

Financial Education Center Seminars

At Delta Community, we know that knowledge is the key to reaching your financial goals and establishing good financial habits. That’s why we’re offering a series of workshops each month focusing on a different aspect of personal finance. Whether you’re planning for a major milestone or trying to better manage your finances, our Financial Education Center offers the tools to help you achieve financial success.

Join us this February for Managing Debt with Confidence, a workshop series focused on cutting expenses, reducing debt and exploring student loan repayment options. Plus, our financial coaching provider, Balance, will share tips for building savings and investment strategies.

Check our Events & Seminars page for more information on upcoming seminars.

Monthly Blogs

- Please Update Your Delta Community Contact Details this Month: Keep your Delta Community accounts running smoothly by making sure we have your current contact information. Whether you’ve moved, changed your phone number or email or updated your legal name, taking a few minutes to review and update your details helps ensure you receive important account notices, statements and timely alerts. Learn why updated contact info matters—including how to adjust your preferences — in our latest blog.

- Don’t Be Scammed by an ATM Skimmer: ATM skimming scams are on the rise, but you can protect yourself with a few simple tips. From what skimmers look like to how to spot suspicious devices before you insert your card, our latest blog breaks down the warning signs and steps you can take to stay safe while banking on the go. Learn more about how to avoid becoming a victim of ATM fraud in our full post.

Financial Status

As of December 31, 2025

- Assets: $8.9B

- Deposits: $7.9B

- Loans: $6.3B

- Members: 529,036

Holiday Closing

Monday, February 16

Presidents' Day, Closed

Contact Us

Member Care: 800-544-3328

Home Loans: 866-963-7811

Locations

EVERYTHING YOUR BANK SHOULD BE™

1. For debt consolidation, even with a lower interest rate or lower monthly payment, paying debt over a longer period of time may result in the payment of more in interest.

2. Submit an official entry form that includes a picture or video of how you and your family save between February 1 and February 28, 2026 (“Sweepstakes Period”) and you'll be automatically entered to win a cash prize of $50 as part of our 2026 Start Small Savings Challenge! For complete sweepstakes rules and details visit www.DeltaCommunityCU.com/StartSmall. NO PURCHASE NECESSARY TO ENTER OR WIN/ / PURCHASE OR SIGNING UP FOR ANY SERVICES WILL NOT INCREASE CHANCES OF WINNING / Membership is not required to participate in the prize drawing. Alternative method of entry available, by way of mail-in entries postmarked during the Sweepstakes Period. Sweepstakes open to US residents 12 years of age and under who are eligible for membership in Delta Community Credit Union. Mail-in Entries must be submitted on a 3x5 card to qualify for entry.