Note: This blog was updated in August 2025 with more current details to enhance its relevancy and readability.

What Is a credit score, why is it important and how does it affect your life?

Whether you’re looking for a credit card, trying to finance a college education or buying your first car, your credit score can have a big impact on your financial future. According to the Atlanta-based national credit scoring and reporting agency Equifax®, “A credit score is a three-digit number designed to represent the likelihood you will pay your bills on time.” By understanding the basics of how credit scores work and why they are important, you’ll be better equipped to make informed decisions about managing your finances.

In the financial industry, lenders use credit scores to measure borrower risk and creditworthiness—these scores allow a lender to understand if someone is likely to pay back the money they owe and how much credit they should be offered.

As opposed to a credit report, which provides a detailed historical record of your loan and financial account information, a credit score summarizes your entire financial history and creditworthiness into a three-digit number, that typically ranges between 300 and 850 for easier (and faster) evaluation. Also, unlike a credit report, which can be supplied by any of the three major credit reporting agencies, most credit scores are calculated by one company called FICO®. That company has claimed on its website that “FICO® Scores are used by the top 90 US lenders for their credit risk assessment needs.”

Before funding a mortgage, approving a credit card or determining the annual percentage rate (APR) of interest charged for a car (or other vehicle) loan, lenders often request the potential borrower’s FICO® Score as part of the application.

How to understand and know your credit score—what it looks like and what it means

How scores are determined, ranked and explained over time can evolve. Here is a version of FICO®’s scoring model, which has been borrowed from (and slightly modified from) its website myfico.com; it is just one example of what a scoring range and related descriptions can look like:

A sample version of FICO® Score Rating Ranges and Rating Explanations

- <580 = Poor — Your score is considerably below the average score of most U.S. consumers and demonstrates to lenders that you are a risky borrower.

- 580-669 = Fair —Your score is below the average score of U.S. consumers, though many lenders may be willing approve loans for someone with this score.

- 670-739 = Good — Your score is near or a little bit above the average of U.S. consumers and most financial lenders consider this a solid score.

- 740-79 = Very Good — Your score is above the average of U.S. consumers and demonstrates to lenders that you are a very dependable borrower who is responsible with their credit obligations.

- 800> = Exceptional/Excellent — Your score is well above the average score of U.S. consumers and strongly demonstrates to lenders that you are an exceptional borrower and worthy of robust credit offers.

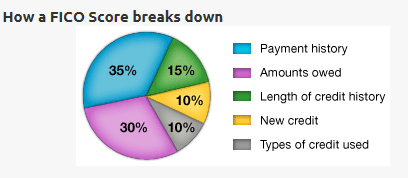

To calculate your credit score, FICO® uses different pieces of credit data and information from your credit report. Traditionally, it seems that the five most important information factors have been payment history, amounts owed, length of credit history, types of credit in use and new credit requests.

While the exact mathematical algorithm (a formula) FICO® uses to calculate scores is proprietary and confidential; it seems that the importance of each category may vary from person to person. This pie chart graph offers a general look at how a credit score might be broken down by a credit scoring or reporting agency:

For most borrowers, a higher credit score can usually lead to lower interest rates on loans and higher credit limits.

Think about your credit score like a school grade for your financial life, and, similarly to a grade, each progressively higher score can bring more benefits.

When you make positive financial decisions, like keeping your accounts in good standing or paying credit card bills on time, your credit score can improve. When you make risky financial decisions, such as maxing out a credit card or carrying a large account debt balance from month to month, your credit score can decrease. As you manage your money, consider how your actions may affect your credit scores and reports.

An example of a credit scores in action and how they can affect your finances

Most people see the impact of their credit score when applying for a loan.

For example, consider two borrowers named Penny and Bill. Both borrowers are in the market for a $15,000, 60-month term, used car loan, but they have different financial habits and, as a result, different credit scores.

Penny, who considers herself more of a committed saver and conservative manager of debt, has paid off her student loans and never carries a monthly unpaid balance on her credit cards. She also monitors her credit card usage so that her balances never get uncomfortably high. She opened a few credit cards after graduating college but always pays them off on time. Her FICO® credit score is 796—set approximately in the Very Good range according to the example above.

Very differently than Penny, Bill likes to regularly buy the latest consumer electronics and fashionable clothes—and, consequently, because of his somewhat indulgent shopping habits, he carries a large balance on his credit cards. He usually makes his monthly loan payments on time, but occasionally he has been late. His FICO® credit score is 654, which places it the Fair category in the list of ranges cited in the previous section of this blog.

When Penny and Bill apply for their auto loans, they may qualify for contrasting annual percentage rates (APR) from their financial lenders, which is the interest rate charged by the lender for a loan. That interest is the profit the lender will make from issuing the loan. Following is one possible (but generally realistic) interest rate and loan payment example for each these borrowers, based on their different credit scores and financial habits:

Each borrower below has been accepted for $15,000, 60-month term, used car loan, and below are the loan features they received from their lender:

| $15,000, 60-month term, used car loan |

Borrower Penny:

Credit Score: 796

Interest Rate: 2.75%

Monthly Payment: approximately $270

Total Interest Paid: approximately $1,100 | Borrower Bill:

Credit Score: 654

Interest Rate: 8.35%

Monthly Payment: approximately $310

Total Interest Paid: approximately $3,450 |

With her higher credit score and lower APR, Penny will not only have a lower monthly payment, but she will also pay less interest over the life of her loan. Because Bill is not as strict with his spending and balance payments, that behavior will result in him paying more money for his loan.

This example could be applied to a personal loan, mortgage, student loan or credit card. Nearly all lenders look at FICO® credit scores (and, possibly, credit reports) when determining the appropriate loan for an applicant. This example illustrates how achieving and maintaining a high credit score has measurable, beneficial advantages for your financial future and can help you access optimal loan rates.

How to find and regularly review your credit scores and reports

Credit reports and scores significantly affect personal finances, so it's important to review your credit scores and reports regularly—such as annually—to know your credit status and check for errors. Errors can affect your credit report and score, and the types of errors may include incorrect personal information such as home addresses, active actual credit cards you now have or inaccurate or false payments and debts.

Each of the three major national credit reporting bureaus in the United States—Equifax®, Experian™ and TransUnion LLC—separately and continuously collect your personal financial history to compile your credit report, which is used to determine your credit score.

Under the Fair Credit Reporting Act (FCRA), which is federal legislation, consumers have been entitled to obtain one free credit report weekly from each credit reporting company, including those mentioned above. To request a copy of a credit report, go online to annualcreditreport.com and follow its instructions to request a report, or call 1-877-322-8228. That site is authorized by the federal government to provide free annual credits reports as required under the FCRA. It is important to understand that to get a free report you are required to provide some sensitive personal information (which may include, but not be limited to, your name, physical home address, Social Security number and date of birth) to verify your identity.

FICO® has at times offered free (and paid) credit scores and credit reports on the myfico.com site that may be worth investigating to determine if it may be an appropriate source for this important personal data. The three national credit reporting bureaus mentioned above may also offer their own, different versions of free and paid credit reports and scores. Some of these companies have offered ongoing, regular and free email notifications of their credit score status to consumers, specifically informing them if their score has decreased or increased each month.

Based on the details and examples above, it’s worth considering that staying knowledgeable on your credit score and reports can have substantial financial and lifestyle benefits that can last a lifetime, and thoughtful financial management could help you better live the life you want.