Delta Community Insights for March 2021

New Full-Service Branch to Open in Chamblee-Brookhaven

We’re excited to announce that we’ll be opening a new metro Atlanta branch in Chamblee-Brookhaven in the fourth quarter of 2021. The full-service branch will be located at 5001 Peachtree Boulevard, in the Peachtree Station Shopping Center. The new branch will offer a full suite of banking services with a staff of loan officers, tellers and member service agents. We look forward to serving members, and welcoming new ones, with this new, convenient location. Follow us on Facebook for updates regarding the progress and opening of the Chamblee-Brookhaven Branch.

Philanthropic Fund Grants Awarded in February

We recently presented two more grants from our 2021 Philanthropic Fund, totaling $17,500, to the organizations listed below:

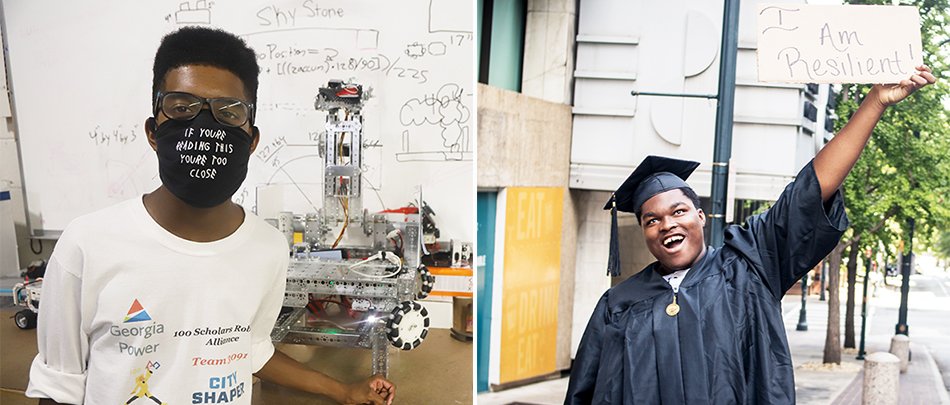

- 100 Black Men of Atlanta, pictured left, accepted an award of $7,500 to go towards their mission of improving the quality of life of Black youth in Atlanta. These funds will be used for their program to help cultivate interest in the pursuit of STEM courses in high school and college.

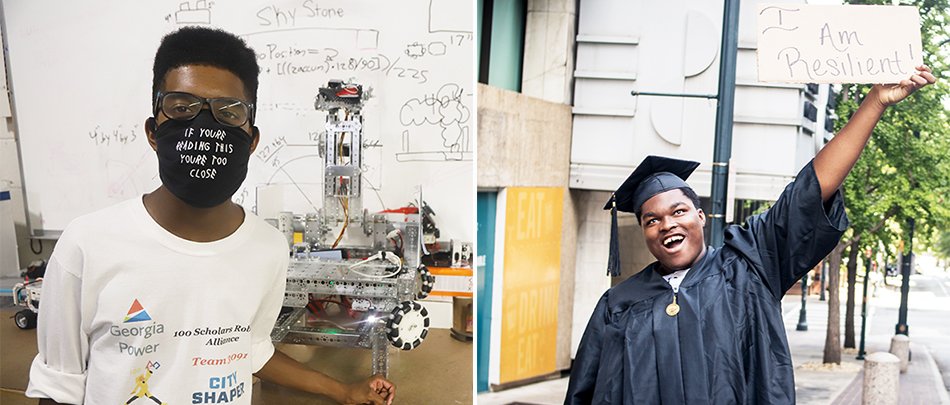

- The Multi-Agency Alliance for Children, pictured right , received an award of $10,000 for their LEADS Program. This program’s mission is to increase high school graduation rates for youth in foster care in Fulton and DeKalb counties by providing the youth with tutoring, school engagement resources, extracurricular activities, social and personal development tools and more.

The Delta Community Philanthropic Fund will invest a total of $125,000 throughout 2021 to 20 metro Atlanta non-profit organizations that support the physical and financial needs of people who live within the communities we serve.

Max Out Your 2020 IRA Before April 15

Maxing out your Individual Retirement Account, or IRA, is an important step towards building savings for the future. With tax season upon us, now is the perfect time to consider making additional contributions to your IRA.

Maxing out an IRA offers great tax benefits. The amount that you contribute may be deductible from your taxable income, meaning your savings can grow, tax-deferred, until you withdraw from the account in retirement. Another advantage of maximizing your contribution is the benefit of compounding growth. The combination of a maximum contribution and dividends can generate growth of your savings, allowing the account to reach its full earning potential. This is an easy way to get higher returns on your IRA and plan wisely for retirement.

The deadline to contribute to an IRA for the 2020 tax year is April 15, 2021, so there is still time to make a tax-deferred contribution. The maximum amount you may contribute for 2020 is $6,000 for individuals under age 50, and $7,000 for those over 50.

Protect Your Family's Financial Future

With Members Insurance Advisors, 1 a wholly owned subsidiary of Delta Community Credit Union, you can now shop multiple A-rated life insurance carriers. 2 You can select from term, whole or child life insurance policies to fit your family’s needs. Policies include coverage amounts of up to $3,000,000 at affordable rates, exclusively for Delta Community members. Request your custom quote today or visit DeltaCommunityCU.com/Life to learn more.

Confirm Your Current Contact Information

Have you recently moved or changed your phone number or email address? It’s a good idea to make sure that your contact information on file with Delta Community is always up-to-date. We must have your current mailing address to send new, or replacement, debit and credit cards, federal tax documents, account statements or letters about your account that require your attention. It’s also very important that we have record of your best phone number in order for us to quickly contact you if there's a problem with your account that we need to discuss with you, such as alerting you to possible fraudulent activity.

To update your personal information, log in to Online Banking, select the Account Management tab and choose Update Personal Information, select More in the Mobile App or stop by any of our branches.

Valentine's Day Giveaway Winner

To help celebrate Valentine’s Day last month, we asked our Facebook followers to share photos of themselves with their Valentines, whether it was their significant other, best friend or children. We had a great response and enjoyed seeing the sweet shots of your loved ones! One lucky winner, selected by random draw, received $100 worth of gift cards for a cozy date night in. Be sure to follow us on Facebook for a chance to enter our next photo submission contest.

Financial Education Center Seminars

At Delta Community, we know that knowledge is the key to reaching your financial goals and establishing good financial habits. That’s why we’re offering a series of workshops each month focusing on a different aspect of personal finance. Whether you’re planning for a major milestone or trying to better manage your finances, our Financial Education Center offers the tools to help you achieve financial success.

March will continue our monthly workshop series with a focus on Credit & Borrowing. We’ll discuss how to understand credit reports, strategies for improving credit scores, the proper use of credit cards, and how to make wise decisions when borrowing money.

- March 4: Understanding Credit Reports | Live Webinar

- March 10: Ways to Improve Credit | Live Webinar

- March 16: Using Credit Wisely | Live Webinar

- March 24: Borrowing Wisely | Live Webinar

Check our Events & Seminars page for more information on upcoming seminars.

Monthly Blog

- Beware of COVID-19 Vaccination Scams: As the COVID-19 corodivirus vaccinations are being distributed and given, scammers, fraudsters and con artists are using fear, uncertainty, doubt and ignorance to try to take advantage of this situation to steal account information and money from vulnerable people who may be tricked into believing disinformation. Read our points about COVID-19 vaccinations to keep in mind to help guard yourself against scams.

- Question Your Security Questions: Just like passwords, security questions can be overcome by hackers, who, if they can learn a little bit about you, can overcome your personal questions with some educated guesswork. Learning your phone number, home address, email address, or Facebook or LinkedIn profile can give them enough information to try to crack your security questions for your accounts, including those for credit cards and other financial services.

Financial Status

As of January 31, 2021

- Assets: $7.8B

- Deposits: $6.9B

- Loans: $4.9B

- Members: 434,464

Holiday Closing

Memorial Day

Monday, May 31

Contact Us

Member Care: 800-544-3328

Home Loans: 866-963-7811

Locations

EVERYTHING YOUR BANK SHOULD BE™

1. Insurance products are not deposits of Delta Community Credit Union and are not protected by the NCUA. They are not an obligation of or guaranteed by Delta Community Credit Union and may be subject to risk. Business conducted with Members Insurance Advisors is separate and distinct from any business conducted with Delta Community Credit Union.

Insured by NCUA.