May 2023

Refer Your Friends and Earn a Special Bonus

Refer your friends, family and eligible coworkers to Delta Community and receive a limited-time double bonus—$100 for each qualified referral through May 31.1 Give the gift of credit union membership to those who are most important in your life—plus, they can get a limited-time bonus of $50 when they join.2

Here’s how to cash in on your double bonus:

- Get your personal referral link at DeltaCommunityCU.com/Refer

- Send your unique referral link to eligible friends via text, email, Facebook, Twitter or LinkedIn

- Get $100 for each friend who opens a Checking Account and meets a few simple requirements

Visit DeltaCommunityCU.com/Refer to share all that’s good about Delta Community and earn extra cash today!

New Advertising Campaign Featuring Members, CEO

At Delta Community, your member experience and what you value matter to us. That’s why we chose to feature real members in our new advertising campaign. The new ads include testimonials from several members talking about why they choose to bank with Delta Community and how the Credit Union has helped them reach their financial goals. The members discuss the broad range of products they have with us, Delta Community’s superior member service and the Credit Union’s involvement in our local communities. You can view the new spots on our YouTube channel.

We also recently developed new spots featuring our CEO, Hank Halter, to address member and consumer concerns given current market and economic pressures. In the ads, Hank explains the credit union difference and details Delta Community’s singular focus on member interests; adherence to safe, proven financial practices; and 83-year history of delivering consistent, trustworthy support. The spots will begin airing on local Atlanta radio stations and broadcast TV later this month.

Get Going with a Car or Vehicle Loan

Delta Community is offering members low rates on new and used Car and Vehicle Loans through May 31.

Well-qualified borrowers with excellent credit can get rates as low as 4.88% APR on new Car Loans, 5.18% APR on used Car Loans and as low as 6.38% APR on loans for boats, motorcycles, RVs and more!3

To apply now, log in to Online Banking or our Mobile App and select Apply for a Loan, or call our Loan Consultant Group at 844-544-9478.

2023 Scholarship Recipients Announced

We recently announced the 2023 recipients of our annual Scholarship Program! Now in its 18th year, the program awarded a total of $25,000 to the following five students based on academic achievement, community service and submission of an essay.

- Giovanni Beltran, a senior at Randall K. Cooper High School in Union, Kentucky, plans to attend the University of Alabama to major in Architecture.

- Ava Flanigan, a senior at Elite Scholars Academy in Jonesboro, Georgia, plans to attend Spelman College in Atlanta to double major in Chemistry and Engineering.

- Joshua Hood, a freshman at Morehouse College in Atlanta, is working towards a dual degree in Engineering with a focus on Computer and Electrical.

- Addison Orr, a senior at Villa Rica High School in Villa Rica, Georgia, plans to attend Berry College in Mt. Berry, Georgia, to major in Education.

- Emily Wagner, a senior at Whitewater High School in Fayetteville, Georgia, plans to attend Auburn University to major in Architecture.

For more information about each of these exceptional students and additional program details, visit DeltaCommunityCU.com/Scholarships.

Make Your Move and Save $500 or More on Closing Costs

Members looking to buy their first home, upgrade or refinance can make the experience easy and affordable with low rates on a variety of Delta Community Home Loans.

Our experienced team of Home Loan Specialists are ready to guide you toward the very best home solutions and quickly answer any questions all the way through closing and beyond. Apply and receive:

- $500 off closing costs on Fixed or Adjustable-Rate Home Loan Purchases through December 314

- $500 off closing costs when you Refinance your Home Loan by May 314

- $1,000 off closing costs on Jumbo Loan Purchases and Refinances by May 315

For more information, or to apply, visit DeltaCommunityCU.com/ComeHome, call 866-963-7811 Option 1, email Home.Loans@DeltaCommunityCU.com or schedule an appointment with a Home Loan Specialist today.

Positively Impact a Child's Life with Zelle and Bill Pay

Looking for a way to make a difference in a child’s life? Delta Community is partnering with Children’s Healthcare of Atlanta (CHOA)6 as a way for our members to help one of Atlanta’s best hospitals. When you make a qualifying Zelle® or Bill Pay transaction now through June 30, $1 will be donated to CHOA, where doctors, nurses and staff are trained to care for children under the age of 21.

Qualifying transactions include adding and paying a new biller, activating a new eBill, setting up an automatic payment, and sending $5 or more to a new person using Zelle®.

Delta Community Credit Union proudly donated $15,000 through this campaign during 2022! Experience the convenience of Zelle® and Bill Pay and help Children’s Healthcare of Atlanta today.

Philanthropic Fund Grants Awarded in April

We recently presented four more grants, totaling $30,000, from our 2023 Philanthropic Fund to the following organizations:

The Frazer Center, pictured above, has a mission to foster inclusive communities where children and adults, with and without disabilities, gather, learn and flourish. The grant will fund their Inclusion Nature-Based Early Education program geared towards low-income children.

Kids’-Doc-On-Wheels is an organization that provides pediatric care to children in schools and daycares. The grant from Delta Community will support its mobile and telemedicine services in Atlanta Title 1 Schools.

Emory University received a grant for their Start: Me Accelerator program, which connects entrepreneurs to resources needed to build and grow their business.

Revved Up Kids, Inc. is a nonprofit focused on protecting children and teens from sexual abuse. They will use the funds from their grant for their internet safety workshop for young teens.

The Delta Community Philanthropic Fund will invest a total of $150,000 throughout 2023 to 20 metro Atlanta nonprofit organizations that support the physical and financial needs of people who live within the communities we serve.

Go For Your Goal Winners

Earlier this year, we invited our youngest members to participate in our “Go For Your Goal” challenge for a chance to win some cash for their Youth Savings Accounts. They were asked to share what they were saving for with drawings, pictures, fun videos, songs, poems or any other creative ways. Congratulations to Archie H., Amara A., Maura O., Liam D., Hunter J., Kristy G., Motasim A., Samiah L., Marcus K. and Kelsey S., who were all awarded $100 for their creations! To see their submissions, visit our Facebook page. Thank you to all those who participated!

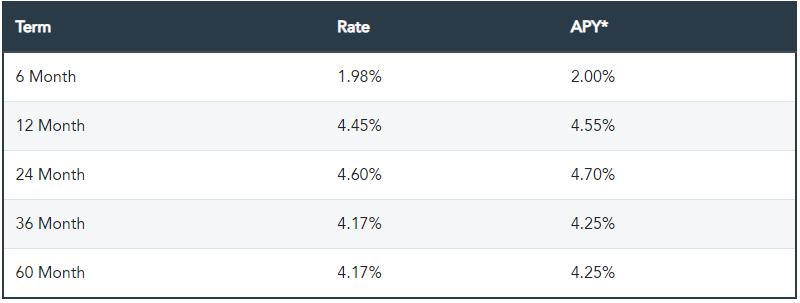

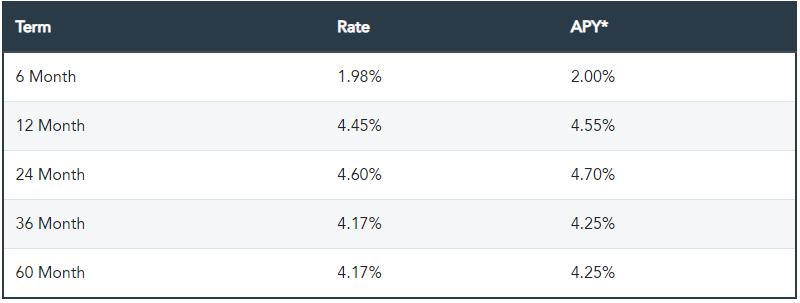

Check Out Our Great CD Rates

Now is the perfect time to open a CD at Delta Community. Interested in high-rate savings options? Make sure to check our website for the most up-to-date rates.7 Rates shown as of May 1, 2023.

Financial Education Center Seminars

At Delta Community, we know that knowledge is the key to reaching your financial goals and establishing good financial habits. That’s why we’re offering a series of workshops each month focusing on a different aspect of personal finance. Whether you’re planning for a major milestone or trying to better manage your finances, our Financial Education Center offers the tools to help you achieve financial success.

Our May series will focus on Home Buying. We’ll discuss the steps for buying your first home, costs to expect with homeownership, what to consider before refinancing or using home equity and how to financially prepare for selling your home. In addition, our financial counseling service BALANCE will review ways seniors can improve their financial health.

- May 9: Financially Savvy Seniors | Live Webinar by BALANCE

- May 10: First-Time Home Buying | Live Webinar

- May 16: Cost of Home Ownership | Live Webinar

- May 18: Financially Savvy Seniors | Live Webinar by BALANCE

- May 23: Refinancing and Using Home Equity | Live Webinar

- May 25: Financially Preparing to Sell Your Home | Live Webinar

Check our Events & Seminars page for more information on upcoming seminars.

Monthly Blogs

- How to Track Your 2022 Federal Tax Refund: Are you expecting a federal tax refund this year? That’s great news, especially if you were hoping to pay bills, store some in savings or investments or to treat yourself (or someone else) to something that’s deserved, fun, and special—maybe even a new car.

- Six Quick Clues that You’re Being Scammed: Scamming is a business that never has an off season; it’s a year-round activity and anyone has an equal opportunity to be defrauded out of money or have their financial accounts illegally accessed and funds stolen. Scammers are experienced, polished and professional, they are quite good at what they do. How can you tell if you're being scammed?

Financial Status

As of March 31, 2023

- Assets: $9.2B

- Deposits: $7.8B

- Loans: $5.8B

- Members: 484,165

Holiday Closing

Memorial Day

Monday, May 29

Contact Us

Member Care: 800-544-3328

Home Loans: 866-963-7811

Locations

EVERYTHING YOUR BANK SHOULD BE™

1. You can earn up to $500 per calendar year. Referrer must be Primary Account Holder with Delta Community. Bonuses earned through this promotion are subject to IRS reporting. Refer-A-Friend bonus cannot be combined with other promotions and is not valid for previous offers or orders. The person you refer must be at least 16 years old to participate in the program. Bonus payments are made within 60 days of program requirements being met. $100 referral bonus offer valid for accounts referred and opened May 1 – June 30, 2023.

2. Applicant must be at least 16 years old, eligible and qualify for membership. To obtain the $100 bonus applicant must (1) Become a member of Delta Community Credit Union by opening a consumer Savings Account with a minimum of $5. Refer-A-Friend Promotion Code must be applied online or in a branch at account opening. Offer not valid if not redeemed by one of these two methods; (2) open a consumer Checking Account within 90 days of opening membership; and (3) deposit $50 to Checking Account and make a minimum of 10 (ten) Visa® Debit Card purchases which post and clear the account within 60 days of Checking Account opening. ATM transactions will not be considered for bonus. To receive bonus, account must be in good standing, with deposit balances above zero dollars, any applicable loan payments current, and all accounts in compliance with any other terms, conditions and governing requirements. Bonuses earned through this promotion are subject to IRS reporting. Please check our website for current rates. The bonus will be deposited to the Checking Account within 60 days after deposit and transaction requirements are met. Offer is valid for first-time Delta Community members only, is not transferable, and cannot be combined with other offers. Offer may only be redeemed once per member.

3. Rates expressed as Annual Percentage Rate (APR). Rates are based on creditworthiness and term of loan. This offer is for new and used cars and vehicles. Income verification may be required. APR available April 1 – May 31, 2023.

4. Receive $500 off closing costs for loan amounts $726,200 or less on Fixed-Rate or Adjustable-Rate Home Purchase Loans and Refinance Loans. Offer for Home Purchase Loans valid for applications received through December 31, 2023 and Refinance offer valid for applications received through May 31, 2023. Offer does not include Home Equity Loans or Home Equity Lines of Credit.

5. Receive $1,000 off closing costs for loan amounts greater than $726,200 (Jumbo Loan) on Fixed-Rate or Adjustable-Rate Home Purchase Loans and Refinance Loans. Offer valid for applications received through May 31, 2023. Offer does not include Home Equity Loans or Home Equity Lines of Credit.

6. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license. This promotion is in no way sponsored, endorsed, administered by or associated with Early Warning Services, LLC or Zelle®.

7. APY=Annual Percentage Yield. Rates are subject to change. The Annual Percentage Yield for a Delta Community Certificate of Deposit is 4.55% for a 1-YR term, 4.70% for a 2-YR term and 4.25% for a 3-YR term. Rates effective beginning May 1, 2023. Minimum opening deposit and balance of $1,000.00 are required. Penalty may be imposed for early withdrawal.