March 2020 Insights

Delta Community Celebrates 80 Years of Service

Dear Members,

I am pleased and proud that this month we are celebrating our 80th anniversary. I also want to congratulate and thank you, our members, for our success.

Delta Community began small but with a big purpose. In early 1940, eight Delta Air Lines employees stationed at Candler Field in Atlanta, Georgia, decided to form a credit union to provide affordable, fair financing to the 200-plus employees. That year, Delta Employees Credit Union was founded with only $45 in share capital, but by the end of the year total assets had grown to an impressive $2,000.

In the 80 years since our founding, Delta Community Credit Union has become Georgia’s largest credit union, with more than 415,000 members, more than $6 billion in assets, 29 branches and 1,100 employees. We are the 26th largest credit union in the United States. While we continue to serve Delta Air Lines employees, we now offer the credit union difference to people who live or work in the 14-county metro Atlanta area, along with employees of more than 140 businesses, including Chick-fil-A, RaceTrac and UPS.

Over eight decades, we have evolved into a full-service financial institution delivering a wide range of financial products and services needed to manage household finances, purchase cars and homes, and save for college and retirement. As part of our commitment to members, we offer you more competitive interest rates, lower fees, and much greater personal service than you usually find at other financial institutions.

Leading up to this important anniversary, 2019 was an exceptional year for Delta Community, as we surpassed 400,000 members. Also, based on calculations using market data on competitors, we returned more than $75 million of value to our members through fewer fees, higher interest rates on deposits and lower rates on loans. I am also very pleased to highlight that we received the highest member satisfaction score among credit unions nationwide in an independent survey.

Last year we also added a new branch and opened up our membership to three more Georgia counties—Douglas, Paulding and Rockdale. For me, one of our special achievements was appearing on the Atlanta Business Chronicle’s list of “Best Places to Work” for the fifth consecutive year; this recognition is based on a survey of our employees and rates their satisfaction with us as an employer.

I’m also proud of our community support last year, as Delta Community invested nearly $850,000 into the Atlanta area. This investment included $100,000 in grants made through our Philanthropic Fund to 24 metro Atlanta charitable organizations; additionally, we provided a number of college scholarships to local students. We also implemented an industry-leading financial literacy program that hosted almost 240 workshops covering 26 different topics that attracted approximately 5,000 attendees.

While 2019 was a great year for us, we are always striving to do more for our members and the communities where you live and work. As we progress, we will continue to uphold our commitment to provide our colleagues and neighbors with better value, honest advice and personalized care.

The mission of our founding members remains as relevant and worthy as ever, and we have renewed energy to deliver on that ideal as we eye our 100th anniversary in 20 short years.

Sincerely,

Hank Halter

Chief Executive Officer

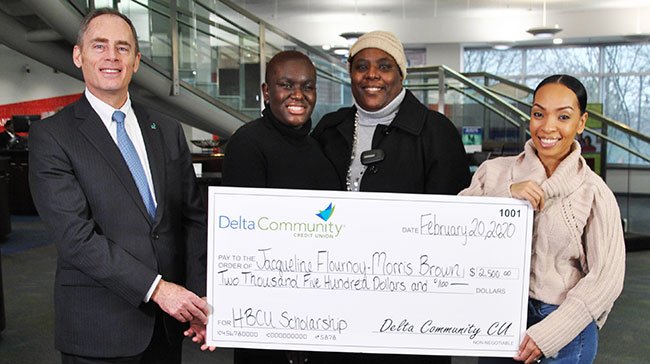

HBCU Scholarship Presented to Morris Brown Student

In February, Delta Community and Atlanta radio station Majic 107.5/97.5 awarded the first $2,500 HBCU Scholarship of 2020 to Jacqueline Flournoy of Atlanta.

Jacqueline is a sophomore at Morris Brown college. She is majoring in Psychology with a minor in Business Administration and hopes to become a clinical psychologist to help those who are underserved in her community. Jacqueline is very involved with campus life, currently serving as President of the Hospitality Club, Sophomore Class President and has been named Miss Sophomore. In addition to on-campus activities, Jacqueline spends much of her free time helping others. She actively volunteers at nursing homes, works with Hosea Williams Feed the Hungry and, after facing her own difficulties, started an anti-bullying campaign.

Throughout 2020, we will award a total of $10,000 in scholarships to students attending Historically Black Colleges and Universities in the state of Georgia. The HBCU Scholarship is part of Delta Community’s annual Scholarship Program. Visit our website to learn more about all of the scholarships that we offer.

Philanthropic Fund Grants Awarded in February

We recently presented two more grants from our 2020 Philanthropic Fund, totaling $20,000, to the organizations listed below:

- Tommy Nobis Center received $10,000 for their Early Youth Employment Services (EYES). The EYES Program prepares youth with disabilities for successful integration into the workforce following graduation by providing job readiness instruction, educational curriculum and life-skills training.

- MUST Ministries accepted an award of $10,000 to put towards their Neighborhood Pantry Program. This program is a network of 33 food pantries for children in need in local public schools.

The Delta Community Philanthropic Fund will invest a total of $100,000 throughout 2020 to 18 metro Atlanta non-profit organizations that support the physical and financial needs of people who live within the communities we serve.

Max Out Your 2019 IRA Before April 15

Maxing out your Individual Retirement Account, or IRA, is an important step towards building savings for the future. With tax season upon us, now is the perfect time to consider making additional contributions to your IRA.

Maxing out an IRA offers great tax benefits. The amount that you contribute may be deductible from your taxable income, meaning your savings can grow, tax deferred, until you withdraw from the account in retirement. Another benefit of maximizing your contribution is the benefit of compounding growth. The combination of a maximum contribution and dividends can generate growth of your savings, allowing the account to reach its full earning potential. This is an easy way to get higher returns on your IRA and plan wisely for retirement.

The deadline to contribute to an IRA for the 2019 tax year is April 15, 2020, so there is still time to make a tax-deferred contribution. The maximum amount you may contribute for 2019 is $6,000 for individuals under age 50, and $7,000 for those over 50.

New Delta Community Website Coming Soon

Our website is being redesigned to better serve your banking and financial services needs. The refreshed site will include improved navigation and a modern, fresh look. More details about the new site will be shared soon on our website, our social media platforms and other member communications as we get closer to launch.

Delta Community Shows Our Love on Valentine's Day

As a small token of appreciation to our members on Valentine’s Day, we spent the day surprising members in our branches with single red roses, boxes of chocolate and stuffed animals. We love and appreciate every member at Delta Community!

Financial Education Center Seminars

Delta Community's comprehensive Financial Education Center is designed to improve the financial lives of our members and community by offering resources on a variety of topics from budgeting to protecting your identity. Every month we offer members several free-onsite workshops.

- March 3: First-Time Home Buying | Delta Community Conference Center

- March 10: Repaying Student Loans | Webinar

- March 11: Sticking to Your Budget | Peachtree City (Wisdom Road)

- March 17: Identity Theft Solutions | Fayetteville

- March 19: Repaying Student Loans | Webinar

- March 26: Using Home Equity | Duluth

Check our Financial Education Center calendar for more information on upcoming seminars.

Monthly Blog

- Making the Most of Your 2019 Tax Refund, Commission or Bonus: An expected refund, commission or bonus can inspire exciting plans for spending your big check. But remember: tax refunds are your money to begin with and you worked hard to earn your bonus.

- New Year's Financial Resolutions You Can Really Keep: For many people, one thing the new year always brings is new year's resolutions—promises to ourselves and others that will take actions to alter—and usually improve—some (or many) aspects of our life. Even though the new year has begun, it's not too late to make or revise resolutions for the rest of the year.

- Check and Document Writing Tips to Help Prevent Fraud: Since checks may be misused by crooks, you should take a few simple precautions when writing personal checks to help make them more resistant to being manipulated by anyone who wants to take your money and/or create problems with your checking account. Because of this year's date of 2020, there's one special detail to note when dating a check and other legal and financial documents.

Financial Status

As of January 31, 2020:

Assets: $6B | Deposits: $5.3B

Loans: $4.8B | Members: 416,053

Holiday Closings

Memorial Day

Monday, May 25

2020 Holiday Closings

Websites

Home Page

Members Insurance

Careers

Contact Us

Member Care: 800-544-3328

Home Loans: 866-963-7811

Locations

EVERYTHING YOUR BANK SHOULD BETM